Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

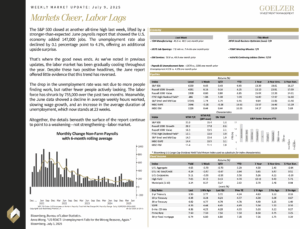

The S&P 500 closed at another all-time high last week, lifted by a stronger-than-expected June payrolls report that showed the U.S. economy added 147,000 jobs. The unemployment rate also declined by 0.1 percentage point to 4.1%, offering an additional upside surprise.

The S&P 500 closed at another all-time high last week, lifted by a stronger-than-expected June payrolls report that showed the U.S. economy added 147,000 jobs. The unemployment rate also declined by 0.1 percentage point to 4.1%, offering an additional upside surprise.

That’s where the good news ends. As we’ve noted in previous updates, the labor market has been gradually cooling throughout the year. Despite these two positive headlines, the June report offered little evidence that this trend has reversed.

The drop in the unemployment rate was not due to more people finding work, but rather fewer people actively looking. The labor force has shrunk by 755,000 over the past two months. Meanwhile, the June data showed a decline in average weekly hours worked, slowing wage growth, and an increase in the average duration of unemployment, which now stands at 23 weeks.

Altogether, the details beneath the surface of the report continue to point to a weakening—not strengthening—labor market.

Weekly Market Update: July 9, 2025