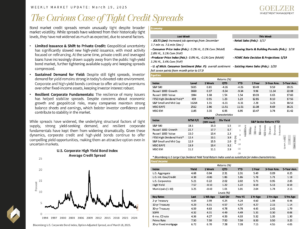

March 19, 2025: The Curious Case of Tight Credit Spreads

Bond market credit spreads remain unusually tight despite broader market volatility. While spreads have widened from their historically tight levels, they have not widened as much as expected, due to several factors.

- Limited Issuance & Shift to Private Credit: Geopolitical uncertainty has significantly slowed new high-yield issuance, with most activity focused on refinancing. At the same time, private credit and leveraged loans have increasingly drawn supply away from the public high-yield bond market, further tightening available supply and keeping spreads compressed.

- Sustained Demand for Yield: Despite still tight spreads, investor demand for yield remains strong in today’s elevated-rate environment. Corporate and high-yield bonds continue to offer attractive premiums over other fixed-income assets, keeping investor interest robust.

- Resilient Corporate Fundamentals: The resilience of many issuers has helped stabilize spreads. Despite concerns about economic growth and geopolitical risks, many companies maintain strong balance sheets and earnings, which bolster investor confidence and contribute to stability in the market.

While spreads have widened, the underlying structural factors of tight supply, strong yield-seeking demand, and resilient corporate fundamentals have kept them from widening dramatically. Given these dynamics, corporate credit and high-yield bonds continue to offer compelling yield opportunities, making them an attractive option even in uncertain markets.

Weekly Market Update: March 19, 2025