J. Andrew Concannon

CFA, CFP®

Senior Partner

Senior Partner

PAUL SIMON, “THE BOXER”

January 2021

For all the economic turmoil and suffering the pandemic caused in 2020, financial markets ended the year looking much like they did at the beginning. Stock valuations are high by historical measures, while bond yields are low. Economists are forecasting economic growth in the year to come, and analysts are predicting better corporate earnings. The primary difference is degree. Compared to one year ago, stock valuations on average are higher, bond yields are lower, and next year’s growth expectations for both the economy and corporate earnings are greater.

As has become tradition, we start the year with an update of our 10-year forecasts for stock and bond returns. Last year, above-average stock valuations and low bond yields caused our models to produce low 10-year return forecasts. This year our models are projecting even lower returns. Our projected 10-year annualized return range for U.S. stocks is 2.1% to 4.2%, well below historical averages.¹ For U.S. bonds, our 10-year forecast is for annualized returns between 1.5% and 2.6%.² It is at this point that you may be asking: “How can I achieve higher returns?” Fortunately, there are a number of possible ways, either from actions you take or from factors that could cause market returns to exceed our forecasts.

You can improve your long-term returns by taking advantage of market volatility. Understand that our projections are based solely on the current entry point and that, because markets are volatile, over the next 10 years many future entry points will provide higher return potential for those investing new cash or rebalancing their portfolios. A good example is this past year’s sudden stock market decline. As stock prices fell, our model’s forward-looking 10-year returns rose, reaching a peak range of 8.0% to 10.3% at the market’s low.

You may also be able to improve returns by expanding your investment universe. Our forecasts are modeled on the S&P 500® Index for stocks and a portfolio of investment-grade corporate and U.S. Treasury securities for bonds. By including investments in foreign stocks, smaller company stocks, higher-yielding types of bonds, private equity, real estate, and other assets, you may be able to increase returns closer to your goals. In doing so, however, you need to understand the risks that go with those investments.

Both stock and bond returns are affected by interest rate levels. Bond returns are directly affected due to long-term returns coming primarily from the interest payments received. Therefore, the sooner interest rates rise, and the longer they remain higher, the greater bond returns will be over the next 10 years. By contrast, stock returns benefit from lower interest

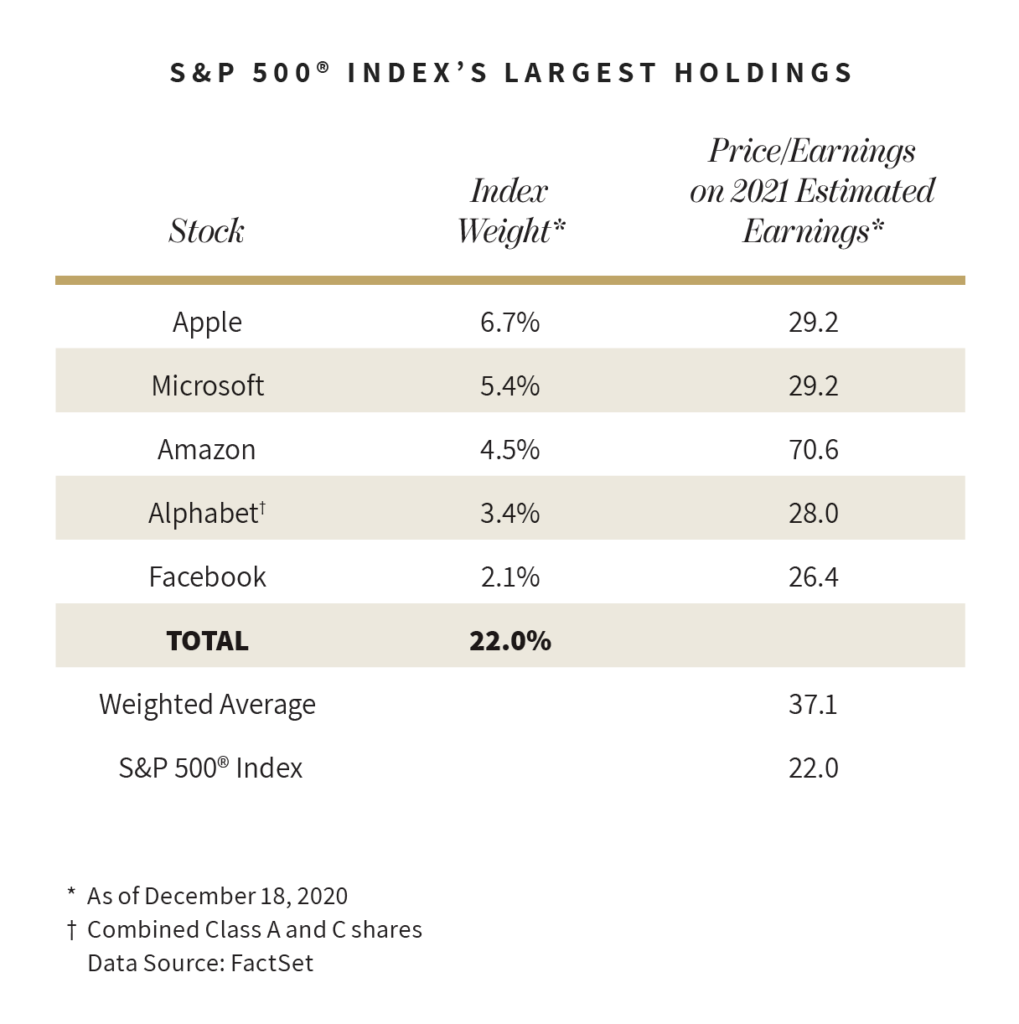

rates. This is because stock valuations typically rise when interest rates are low and fall when interest rates are high. Our stock return model assumes that interest rates and valuations revert to long-term averages at the end of the 10-year period. However, if interest rates are low at the end of the period, valuations would likely be above average, thereby causing returns to be higher than our model’s projection. Of course, whether interest rates will rise or fall is hard to know. Another factor that may cause stock returns to be higher than our model’s forecast is the current top-heaviness of the S&P 500® Index. Recently, both the index’s performance and valuation have been skewed to an unusual degree by its largest member companies. As shown in the table to the right, the five largest companies now account for 22% of the index. Further, those companies all trade at higher valuations than the index, as measured by price divided by earnings (Price/Earnings). Removing those stocks lowers the index’s valuation, thereby resulting in a higher projected 10-year return.

Remarkably, markets have come full circle this past year after dramatic declines in February and March. While that has allowed investors to breathe a sigh of relief, it leaves forward return projections well below historical averages. As investors, we do not get to choose the investment environment, but instead must make the most of the opportunities available. In that way, things are more or less the same.

¹ Our forecast is modeled on the S&P 500® Index as of December 18, 2020.

² Our forecast is modeled on a portfolio of 60% U.S Treasury securities and 40% investment-grade corporate bonds with maturities from one to 10 years as of December 18, 2020.