J. Andrew Concannon

CFA, CFP®

Senior Partner

Senior Partner

April 2022

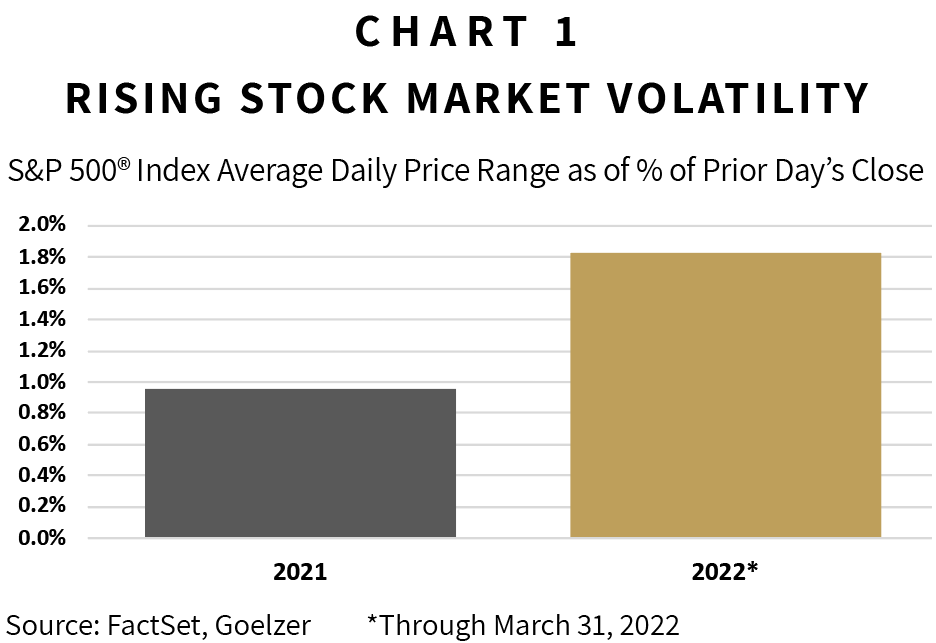

The new year has delivered a sharp jump in volatility across stock, bond, and commodities markets. Chart 1, for example, shows that daily price volatility for the S&P 500® Index has nearly doubled year-to-date versus last year. The blame for this instability lies not with one single item but rather with many. In just the first quarter of the year, investors have been confronted with yet another Covid surge, rising inflation, continued supply-chain bottlenecks, a Federal Reserve pivot toward higher interest rates, and, sadly, a military war in Ukraine that has led to an economic war against its Russian aggressor.

By themselves, each of these issues are cause for concern. Together, they greatly amplify the markets’ typical state of uncertainty. In this issue of Insights, I discuss several of these headwinds, the nature of their causes, and what markets are telling us about the path forward.

Through a combination of globalization and technology, humans can now produce surpluses of nearly all necessary goods—that is, until supply chains are disrupted. Over the past two years, the pandemic caused tremendous shocks to supply chains worldwide. Meanwhile, central banks across the globe rapidly expanded money supply to pay for economic stimulus plans. As a result, more money has chased fewer goods, leaving us with rising inflation.

Now the world’s largest central bank, the U.S. Federal Reserve, is reversing course with plans to begin reducing money supply this year. That, combined with efforts throughout the world to mend supply chains, should lead to lower inflation rates by next year. The caveat is that the war in Ukraine and sanctions on Russia will impose new obstacles for supply chains, thereby interrupting but not stopping progress.

On March 16th, the Federal Reserve announced a quarter-point increase to the federal funds rate along with its intention to add six more quarter-point increases this year. The bond market was out in front of that announcement having raised the yield on 2-year U.S. Treasury notes from 0.2% in September to 1.9% just prior to the announcement. Over the same period, the 10-year U.S. Treasury bond’s yield rose from 1.3% to 2.2%. Further hawkish talk by Federal Reserve officials pushed both 2-year and 10-year yields to 2.3% as of the end of March.

This sudden rise in bond yields, along with the Federal Reserve’s March announcement, may cause investors to wonder how much higher yields can go. Although yields are still low by historical standards, the relative 2 and 10-year U.S. Treasury yield levels suggest we may be nearing a top. Looking at bond yields dating back to 1978 reveals that when 2-year yields climbed above 10-year yields, known as yield curve inversion, 12 months later the 10-year bond’s yield was either lower or just slightly higher in seven out of eight occurrences.

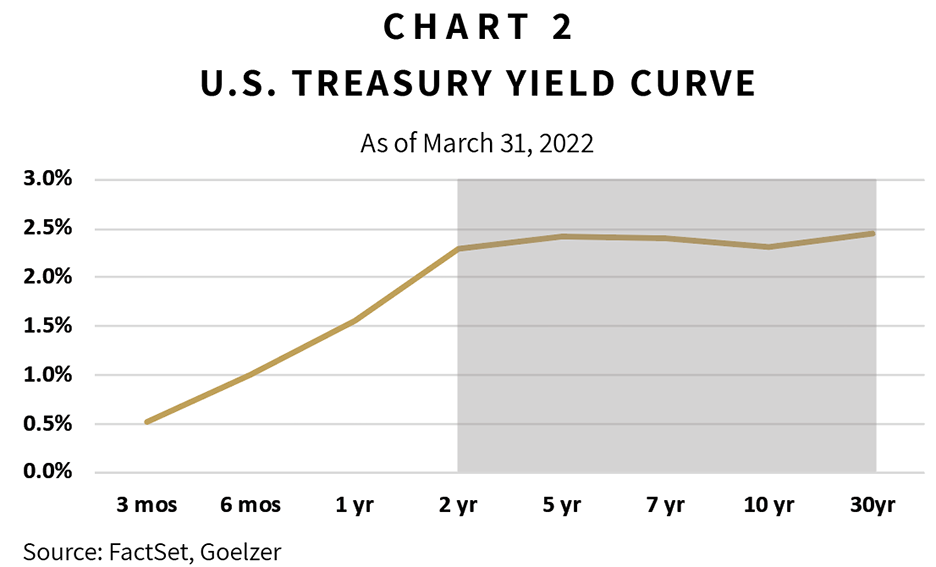

As shown on Chart 2, the current yield curve is nearly flat for bonds with maturities of two years or longer. This is the market’s way of signaling that further rate increases, beyond those already announced, would likely slow the economy to such an extent that the Federal Reserve would reverse course.

Should the bond market be correct in its signaling about the future direction of yields, that is a positive for stock prices. This is because longer-maturity (i.e., 10-year) bond yields and earnings growth are the two most important determinants for stock prices over longer time frames. Earnings growth determines the direction of stock prices while bond yields affect the valuation investors assign to those earnings. Lower bond yields result in higher valuations and vice versa. Therefore, signs of a peak in 10-year bond yields should be interpreted positively.

The risk is that bond yields peak due to an economic slowdown or recession that causes corporate earnings to decline. Consensus earnings estimates, however, are currently positive, predicting not only higher earnings for U.S. companies this year but also rising estimates since the start of the year.1 The combination of growing earnings and a near-term peak in longer-maturity bond yields will be constructive for stock prices should it hold true.

A large cloud hanging over markets is the war in Ukraine. While markets will favor any positive resolution and react negatively to any escalation, investors are void of certainty over the outcome. (Hopefully by the time you read this a resolution will have been reached.) We expect markets to remain hyper-sensitive to headlines and pray for the best outcome for those affected by this war.

Another cloud that is beginning to garner attention is the risk of recession. That risk rises with the Federal Reserve’s steps to tame inflation. The Federal Reserve, of course, will seek to avoid causing a recession; however, its record at orchestrating soft landings is less than stellar. Some forecasters will point to a 2-to-10-year bond-yield inversion as proof of a pending recession. However, it’s important to remember that while each of the last six recessions were preceded by such an inversion, not all inversions have been followed by recession.

Investors are paid a premium for navigating uncertain and volatile times. That is why higher-risk asset classes provide greater long-term returns than lower-risk asset classes. The keys to collecting that premium are investing long-term and following a well-designed plan—two things we emphasize at Goelzer Investment Management.

1 FactSet S&P 500 earnings estimates as of March 31, 2022

DISCLAIMER: The information provided in this piece should not be considered as a recommendation to buy, sell or hold any particular security. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions, or forecasts will prove to be correct. Actual results may differ materially from those we anticipate. The views and strategies described in the piece may not be suitable to all readers and are subject to change without notice. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. The information is not intended to provide and should not be relied on for accounting, legal, and tax advice or investment recommendations. Investing in stocks involves risk, including loss of principal. Past performance is not a guarantee of future results.

ABOUT GOELZER: With over 50 years of experience and more than $2.5 billion in assets under advisement, Goelzer Investment Management is an investment advisory firm that leverages our proprietary investment and financial planning strategies to help successful families and institutions Dream, Invest, and Live.