J. Andrew Concannon

CFA, CFP®

Senior Partner

Senior Partner

July 2021

Investing involves risks. One type of risk we all try to avoid is the permanent loss of money. But a more common risk faced by investors is temporary loss caused by fluctuating asset prices—a risk we’ve experienced to extremes since the pandemic began. This risk is commonly known as volatility.

Investors are often advised not to be concerned with volatility. After all, stock and bond prices fluctuate, and market declines will be recovered over time. Volatility is simply the cost that comes with achieving higher returns. But if we shouldn’t be concerned with volatility, why do investment advisors, including Goelzer, view volatility as an important consideration when building portfolios? It’s because volatility matters when investors take portfolio withdrawals.

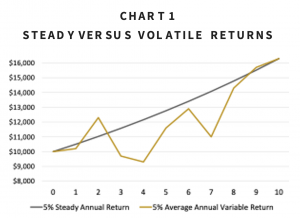

Why would advisors tell investors not to worry about volatility? To explain this, I’ll start with a simple example of two $10,000 portfolios that grow by a 5% average annual rate over 10 years. The difference between the two is that one grows steadily by 5% each year while the other experiences much higher volatility, with annual returns ranging from -21% to +30%. As a result, the two portfolios grow to the same value by the end of the 10-year period, as Chart 1 shows. This, of course, is the argument for why investors should not be concerned with volatility. Regardless of the path taken to get there, if the average returns are the same, the final results are the same.

However true that may be, volatility matters a great deal if the investor with the volatile portfolio needs to withdraw their investment early. In this example, they would fare worse from years 3 through 8 versus if they held the steady portfolio.

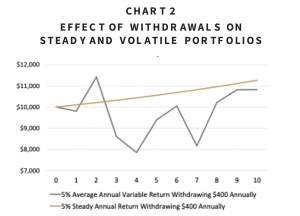

Let’s take it a step further and look at how regularly scheduled withdrawals can affect the outcomes of volatile versus steady portfolios. Here we use the same two portfolios from our last example but withdraw $400 at the end of each year. As shown on Chart 2, despite the withdrawals being equal, the volatile portfolio ends the period with a lower value than the steady portfolio. This is caused by withdrawals being taken during periods when the volatile portfolio’s value is lower than that of the steady portfolio, leaving less money invested to recover from the temporary market declines. The larger the withdrawals or the greater the declines at the time of withdrawals, the bigger the negative effect on the volatile portfolio’s ending value.

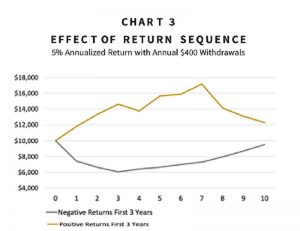

This leads me to another important risk linked to volatility known as sequence risk. This risk is of particular importance to retirees, endowments, foundations, and others who rely on portfolio withdrawals to fund living expenses or services. Sequence risk is the risk that portfolio declines come early during a withdrawal period, thereby leaving less portfolio value available to recover during the next positive return period.

To show an example of sequence risk, we once again start with two $10,000 portfolios that achieve 5% average annual returns and have $400 withdrawals taken at the end of each year. In this example, both portfolios have the same level of volatility, but one experiences negative investment returns during the first three years while the second experiences positive returns during those years.1 As Chart 3 shows, the portfolio that began with a string of negative returns is significantly smaller at the end of the 10-year period.

Fortunately, investors can reduce volatility risk while still striving to achieve competitive long-term returns. The primary method is to combine multiple asset types in a manner that reduces the amount of predicted volatility for a target level of return. This is commonly referred to as asset allocation. Through asset allocation we manage predicted volatility levels by combining lower- volatility assets with higher-volatility assets. For example, low-volatility short-maturity bonds are combined with higher-volatility common stocks. We also pair assets that exhibit negative or low return correlations. In other words, we combine assets that zig when other holdings zag.

Another method is to ensure that multiple years of withdrawals are funded through a combination of portfolio income and monies set aside in low-volatility assets such as money market funds and short-maturity bonds. This eliminates the need to take withdrawals from more volatile holdings during prolonged market declines.

Through these methods we strive to create a portfolio that is well positioned to meet both your longer-term goals and your withdrawal needs.

1Both portfolios have an annual standard deviation of 12%.

DISCLAIMER: The information provided in this material should not be considered as a recommendation to buy, sell, or hold any particular security. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions, or forecasts will prove to be correct. Actual results may differ materially from those we anticipate. The views and strategies described in the piece may not be suitable to all readers and are subject to change without notice. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. The information is not intended to provide and should not be relied on for accounting, legal, and tax advice or investment recommendations. Investing in stocks involves risk, including loss of principal. Past performance is not a guarantee of future results.