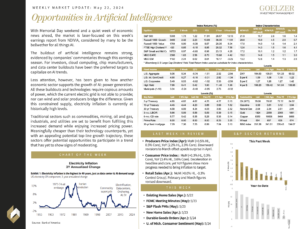

May 22, 2024: Opportunities in Artificial Intelligence

With Memorial Day weekend and a quiet week of economic news ahead, the market is laser-focused on this week’s earnings report from NDIVIA, considered by many to be the bellwether for all things AI.

The buildout of artificial intelligence remains strong, evidenced by companies’ commentaries through this earnings season. For investors, cloud computing, chip manufacturers, and data center buildouts have been the preferred targets to capitalize on AI trends.

Less attention, however, has been given to how another economic sector supports the growth of AI: power generation. All these buildouts and technologies require copious amounts of power, which the current electric grid is not able to provide; nor can wind and solar producers bridge the difference. Given this constrained supply, electricity inflation is currently at historically high levels.

Traditional sectors such as commodities, mining, oil and gas, industrials, and utilities are set to benefit from fulfilling this increased demand while enjoying increased pricing power. Meaningfully cheaper than their technology counterparts, yet with an appealing potential top-line growth trajectory, these sectors offer potential opportunities to participate in a trend that has yet to show signs of moderating.

Weekly Market Update: May 22, 2024