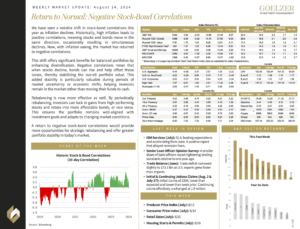

August 14, 2024: Return to Normal: Negative Stock-Bond Correlations

We have seen a notable shift in stock-bond correlations this year as inflation declines. Historically, high inflation leads to positive correlations, meaning stocks and bonds move in the same direction, occasionally resulting in simultaneous declines. Now, with inflation easing, the market has returned to negative correlations.

This shift offers significant benefits for balanced portfolios by enhancing diversification. Negative correlations mean that when stocks decline, bonds can rise and help offset those losses, thereby stabilizing the overall portfolio value. This added stability is particularly valuable during periods of market uncertainty or economic shifts, helping investors remain in the market rather than moving their funds to cash.

Rebalancing is now more effective as well. By periodically rebalancing, investors can lock in gains from high-performing stocks and rotate into more affordable bonds, or vice versa. This ensures the portfolio remains well-aligned with investment goals and adapts to changing market conditions.

A return to negative stock-bond correlations would provide more opportunities for strategic rebalancing and offer greater portfolio stability in today’s market.

Weekly Market Update: August 14, 2024