January 15, 2025: Charting the Tariff Conversation

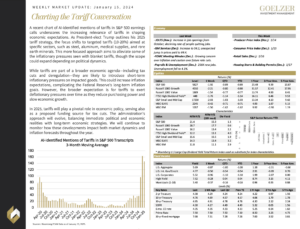

A recent chart of AI-identified mentions of tariffs in S&P 500 earnings calls underscores the increasing relevance of tariffs in shaping economic expectations. As President-elect Trump outlines his 2025 tariff strategy, the focus shifts to targeted tariffs (10-20%) aimed at specific sectors, such as steel, aluminum, medical supplies, and rare earth minerals. This more focused approach aims to alleviate some of the inflationary pressures seen with blanket tariffs, though the scope could expand depending on political dynamics.

While tariffs are part of a broader economic agenda—including tax cuts and deregulation—they are likely to introduce short-term inflationary pressures on impacted goods. This could increase inflation expectations, complicating the Federal Reserve’s long-term inflation goals. However, the broader expectation is for tariffs to exert deflationary pressures over time as they reduce purchasing power and slow economic growth.

In 2025, tariffs will play a pivotal role in economic policy, serving also as a proposed funding source for tax cuts. The administration’s approach will evolve, balancing immediate political and economic realities with long-term economic strategies. We will continue to monitor how these developments impact both market dynamics and inflation forecasts throughout the year.

Weekly Market Update: January 15, 2025