Craig A. Maschmeyer

CFA

Portfolio Manager

Portfolio Manager

Markets move pretty fast. If you don’t stop and look around once in a while, you could miss it.

Markets move pretty fast. If you don’t stop and look around once in a while, you could miss it.

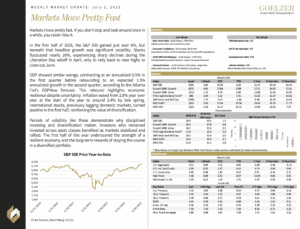

In the first half of 2025, the S&P 500 gained just over 6%, but beneath that headline growth was significant volatility. Stocks fluctuated nearly 20%, experiencing sharp declines during the Liberation Day selloff in April, only to rally back to new highs to close out June.

GDP showed similar swings, contracting at an annualized 0.5% in the first quarter before rebounding to an expected 2.5% annualized growth in the second quarter, according to the Atlanta Fed’s GDPNow forecast. This rebound highlights economic resilience despite uncertainty. Inflation eased from 2.9% year over year at the start of the year to around 2.4% by late spring. International stocks, previously lagging domestic markets, turned positive in the first half, reinforcing the value of diversification.

Periods of volatility like these demonstrate why disciplined investing and diversification matter. Investors who remained invested across asset classes benefited as markets stabilized and rallied. The first half of this year underscored the strength of a resilient economy and the long-term rewards of staying the course in a diversified portfolio.

Weekly Market Update: July 2, 2025