July 16, 2025: CPI’s Controlled Descent

The key datapoint this week is the Consumer Price Index report. While inflation reflects a modest increase from last month, there are no signs that price pressures are spreading across the economy. Markets will likely treat this as just another datapoint rather than a turning point. The outlook remains for a steady policy path with rates rangebound.

The key datapoint this week is the Consumer Price Index report. While inflation reflects a modest increase from last month, there are no signs that price pressures are spreading across the economy. Markets will likely treat this as just another datapoint rather than a turning point. The outlook remains for a steady policy path with rates rangebound.

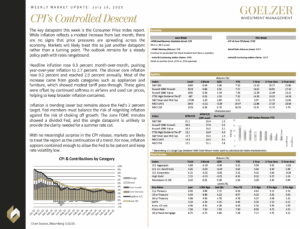

Headline inflation rose 0.3 percent month-over-month, pushing year-over-year inflation to 2.7 percent. The stickier core inflation rose 0.2 percent and reached 2.9 percent annually. Most of the increase came from goods categories such as appliances and furniture, which showed modest tariff pass-through. These gains were offset by continued softness in airfares and used car prices, helping to keep broader inflation contained.

Inflation is trending lower but remains above the Fed’s 2 percent target. Fed members must balance the risk of reigniting inflation against the risk of choking off growth. The June FOMC minutes showed a divided Fed, and this single datapoint is unlikely to provide the clarity needed for a summer rate cut.

With no meaningful surprise in the CPI release, markets are likely to treat the report as the continuation of a trend. For now, inflation appears contained enough to allow the Fed to be patient and keep rate volatility low.

Weekly Market Update: July 16, 2025