Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

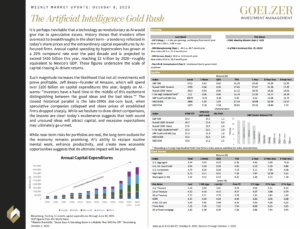

It is perhaps inevitable that a technology as revolutionary as AI would give rise to speculative excess. History shows that investors often overreact to breakthroughs in the short term—a tendency reflected in today’s share prices and the extraordinary capital expenditures by AI-focused firms. Annual capital spending by hyperscalers has grown at a 25% compound rate over the past decade and is projected to exceed $450 billion this year, reaching $2 trillion by 2028—roughly equivalent to Mexico’s GDP. These figures underscore the scale of capital chasing AI-driven returns.

It is perhaps inevitable that a technology as revolutionary as AI would give rise to speculative excess. History shows that investors often overreact to breakthroughs in the short term—a tendency reflected in today’s share prices and the extraordinary capital expenditures by AI-focused firms. Annual capital spending by hyperscalers has grown at a 25% compound rate over the past decade and is projected to exceed $450 billion this year, reaching $2 trillion by 2028—roughly equivalent to Mexico’s GDP. These figures underscore the scale of capital chasing AI-driven returns.

Such magnitude increases the likelihood that not all investments will prove profitable. Jeff Bezos—founder of Amazon, which will spend over $100 billion on capital expenditures this year, largely on AI—warns: “Investors have a hard time in the middle of this excitement distinguishing between the good ideas and the bad ideas.”* The closest historical parallel is the late-1990s dot-com bust, when speculative companies collapsed and share prices of established firms dropped sharply. While we hesitate to draw direct comparisons, the lessons are clear: today’s exuberance suggests that both sound and unsound ideas will attract capital, and excessive expectations may ultimately go unmet.

While near-term risks for portfolios are real, the long-term outlook for the economy remains promising. AI’s ability to replace routine mental work, enhance productivity, and create new economic opportunities suggests that its ultimate impact will be profound.

Weekly Market Update: October 8, 2025

*Alberto Brambilla. “Bezos Says AI Spending Boom Is a Bubble That Will Pay Off.” Bloomberg. October 3, 2025.