Sara J. Omohundro

CFA

Investment Strategist

Investment Strategist

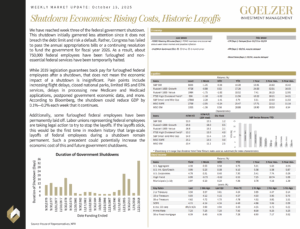

We have reached week three of the federal government shutdown. This shutdown initially garnered less attention since it does not breach the debt limit and risk a default. Rather, Congress has failed to pass the annual appropriations bills or a continuing resolution to fund the government for fiscal year 2026. As a result, about 750,000 federal employees have been furloughed and non-essential federal services have been temporarily halted.

We have reached week three of the federal government shutdown. This shutdown initially garnered less attention since it does not breach the debt limit and risk a default. Rather, Congress has failed to pass the annual appropriations bills or a continuing resolution to fund the government for fiscal year 2026. As a result, about 750,000 federal employees have been furloughed and non-essential federal services have been temporarily halted.

While 2019 legislation guarantees back pay for furloughed federal employees after a shutdown, that does not mean the economic impact of a shutdown is insignificant. Pain points include increasing flight delays, closed national parks, limited IRS and EPA services, delays in processing new Medicare and Medicaid applications, postponed government economic data, and more. According to Bloomberg, the shutdown could reduce GDP by 0.1%—0.2% each week that it continues.

Additionally, some furloughed federal employees have been permanently laid off. Labor unions representing federal employees are taking legal action to try to stop the layoffs. If the layoffs stick, this would be the first time in modern history that large-scale layoffs of federal employees during a shutdown remain permanent. Such a precedent could potentially increase the economic cost of this and future government shutdowns.

Weekly Market Update: October 15, 2025