Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

During his Jackson Hole speech last Friday, Federal Reserve Chair Jerome Powell signaled that the Fed is likely to cut interest rates on September 17th. Powell noted that the balance of risks—between stable prices and stable employment—has shifted toward concerns about a slowing job market. These signs have been evident for months but were confirmed by July’s payroll report and downward revisions to May and June. Through July, monthly job growth has averaged 85,000—a sharp decline from 216,000 in 2023 and 154,000 in 2024.*

During his Jackson Hole speech last Friday, Federal Reserve Chair Jerome Powell signaled that the Fed is likely to cut interest rates on September 17th. Powell noted that the balance of risks—between stable prices and stable employment—has shifted toward concerns about a slowing job market. These signs have been evident for months but were confirmed by July’s payroll report and downward revisions to May and June. Through July, monthly job growth has averaged 85,000—a sharp decline from 216,000 in 2023 and 154,000 in 2024.*

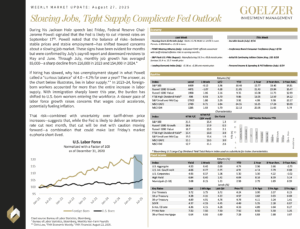

If hiring has slowed, why has unemployment stayed in what Powell called a “curious balance” of 4.0 – 4.2% for over a year? The answer, as the chart below illustrates, lies in labor supply.** In 2023–24, foreign-born workers accounted for more than the entire increase in labor supply. With immigration sharply lower this year, the burden has shifted to U.S.-born workers entering the workforce. A slower pace of labor force growth raises concerns that wages could accelerate, potentially fueling inflation.

That risk—combined with uncertainty over tariff-driven price increases—suggests that, while the Fed is likely to deliver an interest-rate cut next month, that cut will be met with caution moving forward—a combination that could make last Friday’s market euphoria short-lived.

Weekly Market Update: August 27, 2025

* Bureau of Labor Statistics, Bloomberg, Monthly Non-Farm Payrolls

** Chris Low, “FHN Economic Weekly.” FHN Financial. August 22, 2025.