Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

Markets face what one strategist has called a “moment of truth”—a dramatic phrase, to be sure, but fitting given where markets stand and what lies ahead.* The S&P 500 has recently set a series of all-time highs, pushing the index to a lofty valuation of 21 times forward earnings estimates. Bonds, meanwhile, continue to deliver modest, coupon-like returns of 3–4%. All in all, it has been a pleasant summer for investors.

Markets face what one strategist has called a “moment of truth”—a dramatic phrase, to be sure, but fitting given where markets stand and what lies ahead.* The S&P 500 has recently set a series of all-time highs, pushing the index to a lofty valuation of 21 times forward earnings estimates. Bonds, meanwhile, continue to deliver modest, coupon-like returns of 3–4%. All in all, it has been a pleasant summer for investors.

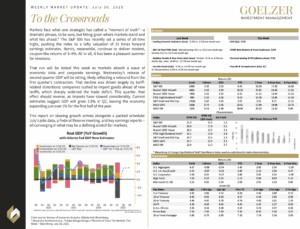

That run will be tested this week as markets absorb a wave of economic data and corporate earnings. Wednesday’s release of second-quarter GDP will be telling, likely reflecting a rebound from the first quarter’s contraction. That decline was driven largely by tariff-related distortions: companies rushed to import goods ahead of new tariffs, which sharply widened the trade deficit. This quarter, that effect should reverse, as imports have slowed considerably. Current estimates suggest GDP will grow 2.9% in Q2, leaving the economy expanding just over 1% for the first half of the year.

This report on slowing growth arrives alongside a packed schedule: July’s jobs data, a Federal Reserve meeting, and key earnings reports—all converging in what may be a defining stretch for markets.

Weekly Market Update: July 30, 2025

* Alexandra Semenova et al. “A Data Deluge Brings a ‘Moment of Truth’ for Markets This Week.” Bloomberg. July 28, 2025.