July 31, 2024: A Welcome Rally in Beleaguered Stocks

A rotation out of the crowded AI trade has benefited beleaguered small cap and value stocks. A historically narrow market, led by a handful of large tech companies, left many market watchers anticipating that companies with cheaper valuations would eventually catch up, at least momentarily. However, cheap valuations are not the only factor supporting an equity market broadening. Resurging demand for infrastructure to support AI and related technology also helps.

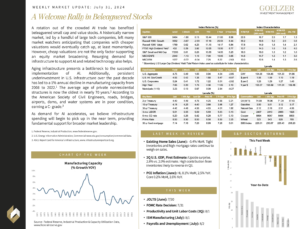

Aging infrastructure presents a bottleneck to the successful implementation of AI. Additionally, persistent underinvestment in U.S. infrastructure over the past decade has led to a 1% annual decline in manufacturing capacity from 2008 to 2022.1 The average age of private nonresidential structures is now the oldest in nearly 70 years.2 According to the American Society of Civil Engineers, roads, bridges, airports, dams, and water systems are in poor condition, earning a C- grade.3

As demand for AI accelerates, we believe infrastructure spending will begin to pick up in the near term, providing fundamental support for broader market leadership.

1. Federal Reserve, Industrial Production, www.federalreserve.gov.

2. U.S. Energy Information Administration, Commercial www.eia.gov/consumption/commercial/data.

3. ASCE Report Card for America’s Infrastructure, www.infrastructurereportcard.org.

Weekly Market Update: July 31, 2024