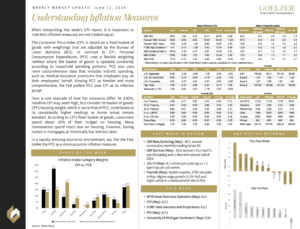

June 12, 2024: Understanding Inflation Measures

When interpreting this week’s CPI report, it is important to note that inflation measures are not created equal.

The Consumer Price Index (CPI) is based on a fixed basket of goods with weightings that are adjusted by the Bureau of Labor Statistics (BLS). In contrast to CPI, Personal Consumption Expenditures (PCE) uses a flexible weighting method where the basket of goods is updated constantly according to household spending patterns. PCE also uses more comprehensive data that includes indirect spending, such as medical-insurance premiums that employers pay on their employees’ behalf. Viewing PCE as timelier and more comprehensive, the Fed prefers PCE over CPI as its inflation gauge.

Here is one example of how the measures differ. At 3.40%, headline CPI may seem high, but consider its basket of goods: CPI’s housing weight, which is twice that of PCE, contributes to its consistently higher readings as home prices remain elevated. According to CPI’s fixed basket of goods, consumers spend about 30% of their budget on housing. Many homeowners spend much less on housing, however, having locked in mortgages at historically low interest rates.

In a rapidly evolving economic environment, we, like the Fed, prefer the PCE as a more accurate inflation measure.

Weekly Market Update: June 12, 2024