May 21, 2025: Mounting Deficits Fuel Steepening of Treasury Yield Curve

All eyes are on Washington this month as Treasury yields continue to climb. Moody’s recent downgrade of US debt to Aa1 has added pressure across the curve, and remarks from Treasury Secretary Bessent failed to calm markets. Mounting budget deficits and increased long-term issuance will keep long yields elevated regardless of Fed policy at the short end.

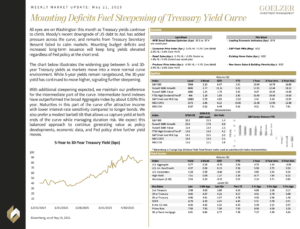

The chart below illustrates the widening gap between 5- and 30-year Treasury yields as markets move into a more normal curve environment. While 5-year yields remain rangebound, the 30-year yield has continued to move higher, signaling further steepening.

With additional steepening expected, we maintain our preference for the intermediate part of the curve. Intermediate bond indexes have outperformed the broad Aggregate index by about 0.50% this year. Maturities in this part of the curve offer attractive income with lower interest-rate sensitivity compared to longer bonds. We also prefer a modest barbell tilt that allows us capture yield at both ends of the curve while managing duration risk. We expect this balanced approach to continue generating value as policy developments, economic data, and Fed policy drive further yield moves.

Weekly Market Update: May 21, 2025