Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

In January, we framed the year ahead with the theme of “paranoid optimism.” Nine months later, it still fits: optimism fueled by growth, paranoia by policy shifts and data surprises.

In January, we framed the year ahead with the theme of “paranoid optimism.” Nine months later, it still fits: optimism fueled by growth, paranoia by policy shifts and data surprises.

The optimism case was built on a sturdy job market, tax and regulatory tailwinds, and a revival of “animal spirits.” Markets have reflected that strength: the S&P 500 has gained 14% year to date, hitting record highs, while small caps showed signs of life and the bond market remained stable.

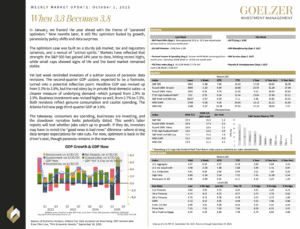

Yet last week reminded investors of a subtler source of paranoia: data revisions. The second-quarter GDP update, expected to be a footnote, turned into a potential inflection point. Headline GDP was revised up from 3.3% to 3.8%, but the real story lay in private final domestic sales—a cleaner measure of underlying demand—which jumped from 1.9% to 2.9%. Business investment was revised higher as well, from 5.7% to 7.3%. Both revisions reflect genuine consumption and capital spending. The Atlanta Fed now pegs third-quarter GDP at 3.9%.

The takeaway: consumers are spending, businesses are investing, and the slowdown narrative looks potentially dated. This week’s labor reports will test whether jobs catch up to growth. If they do, investors may have to revisit the “good news is bad news” dilemma—where strong data temper expectations for rate cuts. For now, optimism is back in the driver’s seat, though paranoia remains in the rearview.

Weekly Market Update: October 1, 2025