Chief Investment Officer | Principal

April 2022

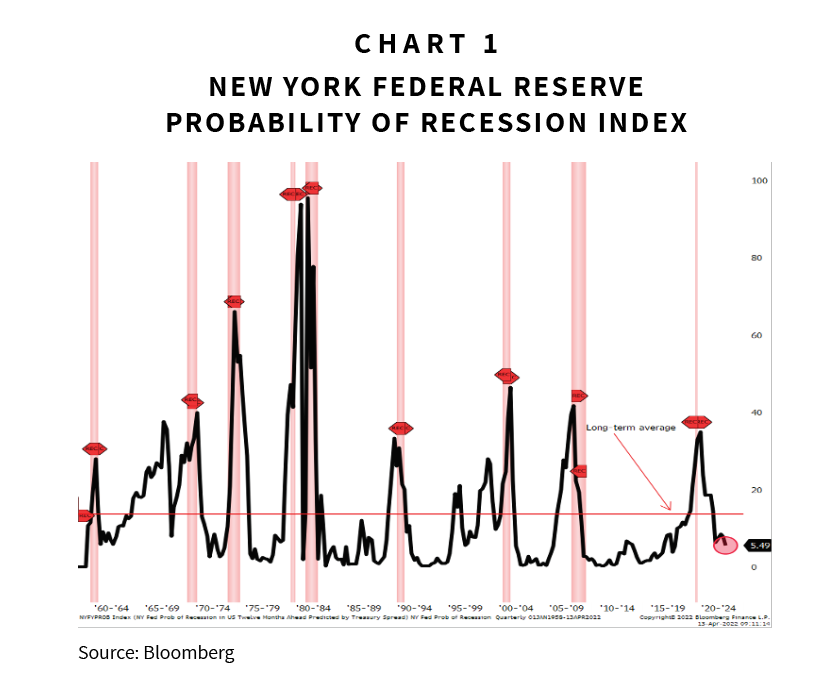

Prior to each of the past six U.S. economic recessions, the yield on 2-year U.S. Treasury notes has risen above the yield on 10-year U.S. Treasury bonds—a situation commonly known as a yield-curve inversion. While a yield-curve inversion is not a guarantee of recession, the recent inversion of the 2-10 year U.S. Treasury yield curve has led many to ask about the probability of a near-term recession.

In addition to aggregate indicators such as the Conference Board’s Leading Economic Index, we will watch related individual indicators to assess the odds of recession. Each has provided meaningful recessionary signals since their inceptions. Based on where these signals stand today, we do not see high probability of recession within the next 12 months.

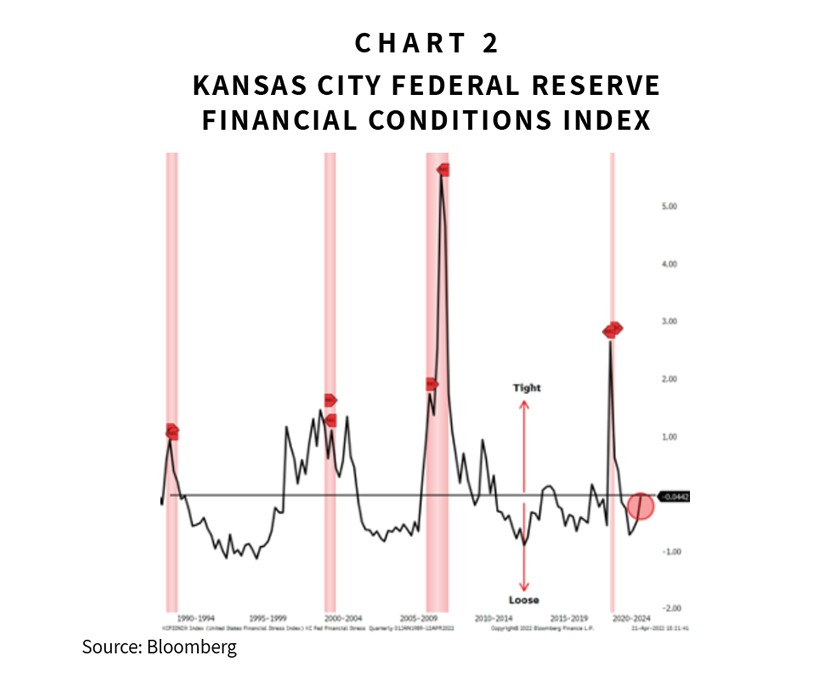

As the Federal Reserve tightens policy, financial conditions should tighten broadly across the economy. These conditions include, but are not limited to, short-term lending rates, corporate bond spreads, and consumer lending rates. As these conditions tighten, ensuing economic activity—including business investment, home purchases, and mortgage refinancing—will slow.

The chart below shows financial conditions as measured by the Kansas City Federal Reserve Bank. Tightening of financial conditions tends to precede recessions. By historical standards, today’s conditions can be defined as “loose” but are likely to tighten over the coming months.

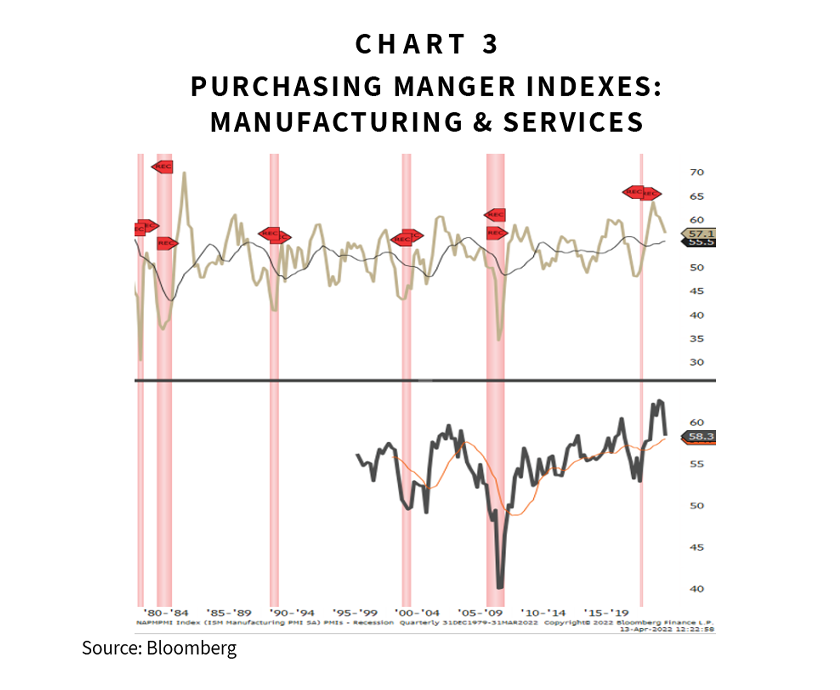

Purchasing manager indexes (PMIs) provide insight into prevailing trends in the economy, with indexes available both for the manufacturing and services sectors. Manufacturing PMIs have exhibited downward trends before each of the five recessions since 1980. Services PMIs have exhibited similar trends preceding recessions since that index’s inception in 1997.2 Important to note, however, is that not all downward trends in these figures have led to recession. Assessing the levels of these indexes, in connection with their direction, is critical.

While both measures have slowed over the past three months, they are retreating from historically high levels and do not indicate economic contraction within the next 12 months.3

A third indicator offers even stronger support against increasing the probability of recession beyond its historical average: changes in employment.

By nearly all measures labor markets are tight:

The Sahm rule is a useful indicator for gauging adverse changes in the labor market. This rule measures changes in the unemployment rate over a trailing three-month period relative to its trailing 12-month low. Positive readings indicate weakening labor markets; readings above 0.5% (a one-half percentage point increase in unemployment) have preceded all recessions since the rule’s inception in 1959. At its current level of -0.1% the Sahm rule reflects the strengthening, not weakening, of the labor market. Absent weakening labor markets, we view the probability of near-term recession as remote.

Our view: Over the next 12 months, economic growth will slow, consistent with entering later stages of the business cycle. We find support for this view in at least three places:

As our recent Insights piece noted, investors are “Sorting Through the Headwinds” as they assess the course of the economy and the outlook for markets. These headwinds have combined to produce growing concerns over near-term recession. We view the probability of a near-term recession (next 12 months) as no greater than average. However, the Federal Reserve’s actions to tame inflation are likely to raise the recession odds as we move through 2023. Therefore, we will be monitoring the recession signals included above for signs of slowing.

1 As of March 31, 2022.

2 Measured on a rolling 12-month basis, 12 months before official start of economic recession.

3 While the first two indicators (financial conditions and purchasing-manger indexes) have weakened over the first quarter, they have not weakened to the extent that would cause us to increase our odds of recession. While directionally negative, the absolute levels of both indicators suggest economic expansion, not contraction.

DISCLAIMER: The information provided in this material should not be considered as a recommendation to buy, sell or hold any particular security. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions, or forecasts will prove to be correct. Actual results may differ materially from those we anticipate. The views and strategies described in the piece may not be suitable to all readers and are subject to change without notice. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. The information is not intended to provide and should not be relied on for accounting, legal, and tax advice or investment recommendations. Investing in stocks involves risk, including loss of principal. Past performance is not a guarantee of future results.