Sara J. Omohundro

CFA

Investment Strategist

Investment Strategist

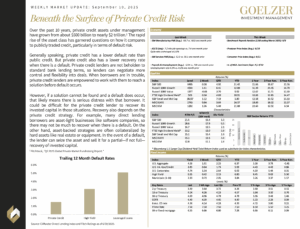

Over the past 10 years, private credit assets under management have grown from about $500 billion to nearly $2 trillion.1 The rapid rise of the asset class has garnered questions on how it compares to publicly traded credit, particularly in terms of default risk.

Over the past 10 years, private credit assets under management have grown from about $500 billion to nearly $2 trillion.1 The rapid rise of the asset class has garnered questions on how it compares to publicly traded credit, particularly in terms of default risk.

Generally speaking, private credit has a lower default rate than public credit. But private credit also has a lower recovery rate when there is a default. Private credit lenders are not beholden to standard bank lending terms, so lenders can negotiate more control and flexibility into deals. When borrowers are in trouble, private credit lenders are empowered to work with them to reach a solution before default occurs.

However, if a solution cannot be found and a default does occur, that likely means there is serious distress with that borrower. It could be difficult for the private credit lender to recover its invested capital in those situations. Recovery also depends on the private credit strategy. For example, many direct lending borrowers are asset-light businesses like software companies, so there may not be much to recover when there is a default. On the other hand, asset-backed strategies are often collateralized by hard assets like real estate or equipment. In the event of a default, the lender can seize the asset and sell it for a partial—if not full—recovery of invested capital.

Weekly Market Update: September 10, 2025

1 Pitchbook, “Q2 2025 Global Private Market Fundraising Report.”