September 25, 2024: Another Atypical Rate-Cut Cycle

Periods in which the Federal Reserve lowers interest rates have typically been positive for equities. Moreover, defensive stocks, such as those found in the consumer-staples sector, have tended to outperform cyclical stocks during early phases of rate-cut cycles—cycles that have often begun as corporate earnings growth decelerate. However, the circumstances surrounding each rate-cut cycle are different, and this cycle is no exception.

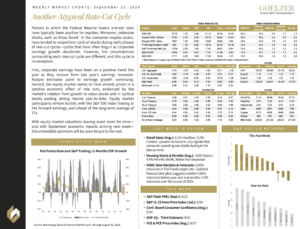

First, corporate earnings have been on a positive trend this year as they recover from last year’s earnings recession. Analyst estimates point to earnings growth continuing. Second, the equity market seems to have already priced in a positive economic effect of rate cuts, evidenced by the market’s rotation from growth to value stocks and in cyclical stocks posting strong returns year-to-date. Equity market participants remain bullish, with the S&P 500 Index trading at 24x forward earnings, well ahead of the long-term average of 17x.

With equity market valuations leaving scant room for error—and with September economic reports arriving next week—this embedded optimism will be soon be put to the test.

Weekly Market Update: September 25, 2024