Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

Markets are in a strange place: another week, another series of all-time highs in the stock market. Another week, and further evidence—this time a collective downward revision of 900,000 in monthly jobs created through March 2025—of a weak job market.

Markets are in a strange place: another week, another series of all-time highs in the stock market. Another week, and further evidence—this time a collective downward revision of 900,000 in monthly jobs created through March 2025—of a weak job market.

How to make sense of this? The prospect of interest rate cuts, possibly as soon as this week, helps explain some of the market’s positivity. Yet focusing solely on lower rates misses the larger picture—one that points to strength in consumer spending and a surprisingly resilient economy.

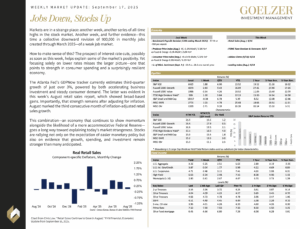

The Atlanta Fed’s GDPNow tracker currently estimates third-quarter growth of just over 3%, powered by both accelerating business investment and steady consumer demand. The latter was evident in this week’s August retail sales report, which showed broad-based gains. Importantly, that strength remains after adjusting for inflation. August marked the third consecutive month of inflation-adjusted retail sales growth.

This combination—an economy that continues to show momentum alongside the likelihood of a more accommodative Federal Reserve—goes a long way toward explaining today’s market strangeness. Stocks are rallying not only on the expectation of easier monetary policy but also on evidence that growth, spending, and investment remain stronger than many anticipated.

Weekly Market Update: September 17, 2025