Chief Investment Officer | Principal

Among inflation reports, the monthly Producer Price Index (PPI) tends to receive less attention than the Consumer Price Index (CPI). While CPI reflects changes in consumer-level prices, the PPI tracks price movements at the producer level. Because it captures costs earlier in the production chain, the PPI is often viewed as a leading indicator of inflation. Last week, however, this typically overlooked report drew outsized attention for what it might signal about the direction of consumer prices.

Among inflation reports, the monthly Producer Price Index (PPI) tends to receive less attention than the Consumer Price Index (CPI). While CPI reflects changes in consumer-level prices, the PPI tracks price movements at the producer level. Because it captures costs earlier in the production chain, the PPI is often viewed as a leading indicator of inflation. Last week, however, this typically overlooked report drew outsized attention for what it might signal about the direction of consumer prices.

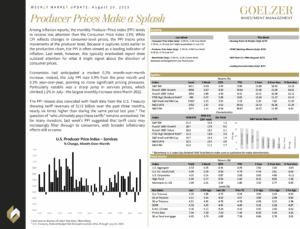

Economists had anticipated a modest 0.2% month-over-month increase. Instead, the July PPI rose 0.9% from the prior month and 3.3% year-over-year, pointing to more significant pricing pressures. Particularly notable was a sharp jump in services prices, which climbed 1.1% in July—the largest monthly increase since March 2022.

The PPI release also coincided with fresh data from the U.S. Treasury showing tariff revenues of $113 billion over the past three months, nearly six times higher than during the same period last year.* The question of “who ultimately pays these tariffs” remains unresolved. Yet for many investors, last week’s PPI suggested that tariff costs may increasingly filter through to consumers, with broader inflationary effects still to come.

Weekly Market Update: August 20, 2025

* U.S. Treasury, Federal Budget Net Receipts Customs NSA, through July 31, 2025.