Gavin W. Stephens

CFA

Chief Investment Officer

Chief Investment Officer

Lower bars are easier to hurdle—a truism in both track and field and business. That appears to be the setup for second-quarter earnings season, which officially began last week with reports from the U.S.’s largest banks. While the season is still in its early stages, expectations are low enough—just 2.8% year-over-year expected growth, compared to 13% realized growth in Q1—for most companies to surpass them.1

Lower bars are easier to hurdle—a truism in both track and field and business. That appears to be the setup for second-quarter earnings season, which officially began last week with reports from the U.S.’s largest banks. While the season is still in its early stages, expectations are low enough—just 2.8% year-over-year expected growth, compared to 13% realized growth in Q1—for most companies to surpass them.1

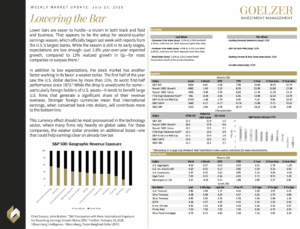

In addition to low expectations, the stock market has another factor working in its favor: a weaker dollar. The first half of the year saw the U.S. dollar decline by more than 11%, its worst first-half performance since 1973.2 While the drop is unwelcome for some—particularly foreign holders of U.S. assets—it tends to benefit large U.S. firms that generate a significant share of their revenue overseas. Stronger foreign currencies mean that international earnings, when converted back into dollars, will contribute more to the bottom line.

This currency effect should be most pronounced in the technology sector, where many firms rely heavily on global sales. For these companies, the weaker dollar provides an additional boost—one that could help earnings clear an already low bar.

Weekly Market Update: July 23, 2025

1 Bloomberg Intelligence

2 Bloomberg, Trade Weighted Dollar (DXY).