Chief Investment Officer | Principal

Small-cap stocks, long among the most unloved parts of the U.S. market, have finally shown signs of life. Since bottoming on April 8, the widely followed Russell 2000 has rallied 40% and just surpassed its prior all-time high from 2021.

Small-cap stocks, long among the most unloved parts of the U.S. market, have finally shown signs of life. Since bottoming on April 8, the widely followed Russell 2000 has rallied 40% and just surpassed its prior all-time high from 2021.

The simplest explanation is interest rates. Small-cap companies generally carry more floating-rate debt than their large-cap peers. When short-term rates fall, their interest burdens decline and their earnings outlook improves.

But rate cuts are not the whole story. Small caps are also benefiting from renewed focus on the so-called “Trump trade”—a market theme that favors domestically oriented companies expected to gain from deregulation and tax cuts. With trade tensions fading from the headlines, investors are paying more attention to these potential tailwinds.

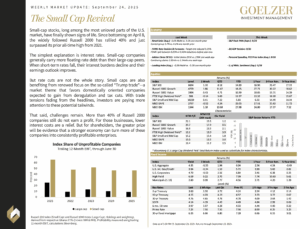

That said, challenges remain. More than 40% of Russell 2000 companies still do not earn a profit. For those businesses, lower interest costs are a relief. But for shareholders, the greater prize will be evidence that a stronger economy can turn more of these companies into consistently profitable enterprises.

Weekly Market Update: September 24, 2025