When you become a client at Goelzer, you are served by a team of experienced investment professionals.

We are disciplined, thoughtful, and research-driven—aiming for a holistic approach and acting as good stewards of your financial resources.

We pride ourselves on being client-centric, using planning-led solutions to deliver value. By managing your investments, we aim to help you achieve your goals, gain peace of mind, and feel more fulfilled.

about your goals and dreams

to uncover investment opportunities

in a portfolio that merges your goals with our research

to control risk while seeking positive returns

so you understand your portfolio and its performance

As a client of Goelzer, you receive our full attention and guidance, which we deliver as a fiduciary.

Creating and maintaining a portfolio that meets your risk tolerance.

Planning for a comfortable, fulfilling retirement.

Continually assessing the performance of your investments.

Determining the future of your wealth and assets.

Making the largest impact while creating tax efficiency.

Fees are based on assets under management, with a minimum of $1 million. We have fixed advisory fees for certain services including financial planning. We never charge transaction fees or collect any product-related commissions.

Goelzer’s private client advisors average over 30 years of experience, leveraging deep insights to best serve you.

Managing Director, Private Client

Managing Director, Private Client

B.S., Miami University in Oxford, OH

M.B.A., DePaul University, Chicago, IL

32 years

2012

Brian is a member of the CFA Institute and the CFA Society of Indianapolis.

Board Member of College Mentors for Kids.

Brian is a member of the CFA Institute and the CFA Society of Indianapolis.

Board Member of College Mentors for Kids.

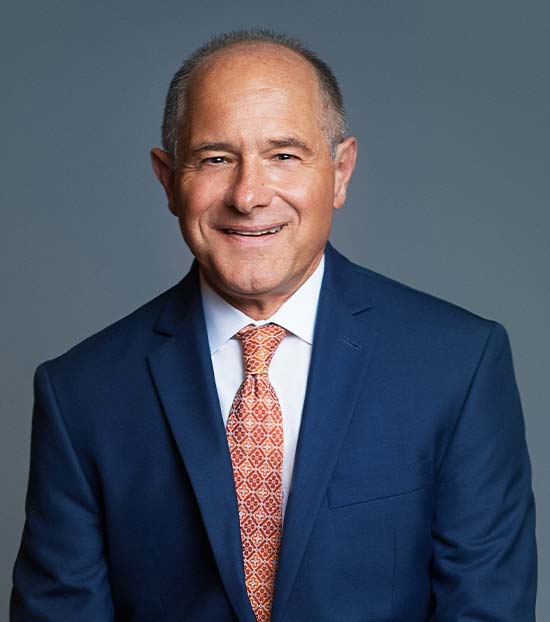

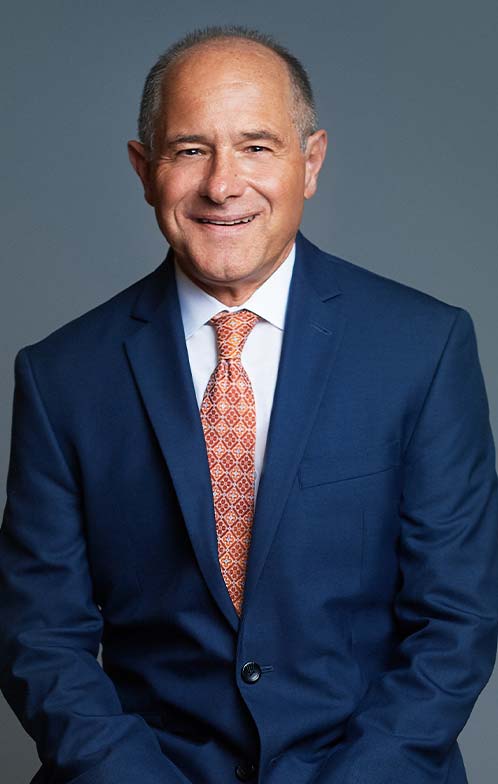

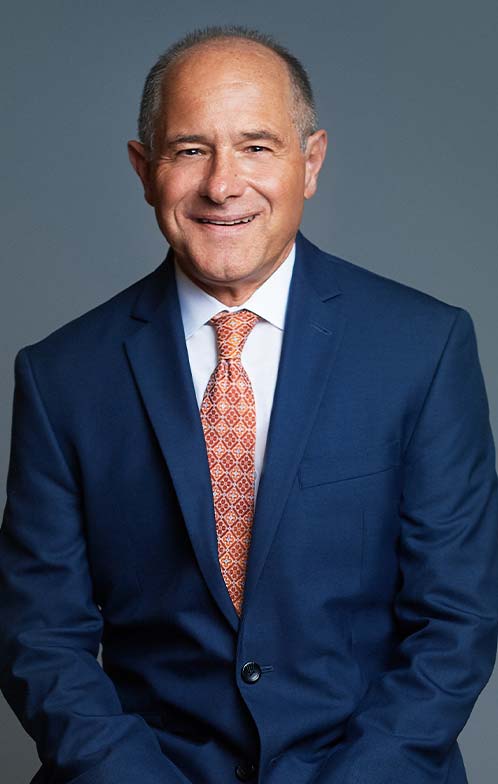

President

President

B.S., Indiana University

34 years

1990

Indianapolis Business Journal’s “40 Under Forty” Award 2000. Brett is a member of the CFA Institute and CFA Society of Indianapolis.

Former Chapter Chair & Life Trustee of the Indiana Chapter of The Nature Conservancy, Treasurer & Chair of the Finance Committee of Indiana Landmarks, Member of the Indiana University School of Medicine Planned Giving Committee, and the Indiana University Kelley School of Business Dean’s Council.

Indianapolis Business Journal’s “40 Under Forty” Award 2000. Brett is a member of the CFA Institute and CFA Society of Indianapolis.

Former Chapter Chair & Life Trustee of the Indiana Chapter of The Nature Conservancy, Treasurer & Chair of the Finance Committee of Indiana Landmarks, Member of the Indiana University School of Medicine Planned Giving Committee, and the Indiana University Kelley School of Business Dean’s Council.

Senior Partner

Senior Partner

B.S., Ball State University (Cum Laude)

36 years

2005

Andy is a member of the CFA Institute and CFA Society of Indianapolis.

Jameson Camp, former Board Member and Past President. Andy is also a member of the Indiana School of Medicine Planned Giving Committee and a previous board member of the CFA Society of Indianapolis.

Andy is a member of the CFA Institute and CFA Society of Indianapolis.

Jameson Camp, former Board Member and Past President. Andy is also a member of the Indiana School of Medicine Planned Giving Committee and a previous board member of the CFA Society of Indianapolis.

Director of Goelzer Private Office, Senior Wealth Advisor

Director of Goelzer Private Office, Senior Wealth Advisor

B.S., Huntington University

25 years

2021

Member of the CFA Institute and CFA Society of Indianapolis and a volunteer at Ronald McDonald House of Central Indiana. Previously served as coach of Zionsville Youth Baseball.

Board Treasurer for Herron Classical Schools, Member of President’s Advisory Council for Excellence – Huntington University and Ronald McDonald House Charities (past)

Member of the CFA Institute and CFA Society of Indianapolis and a volunteer at Ronald McDonald House of Central Indiana. Previously served as coach of Zionsville Youth Baseball.

Board Treasurer for Herron Classical Schools, Member of President’s Advisory Council for Excellence – Huntington University and Ronald McDonald House Charities (past)

Director of Wealth Planning, Senior Wealth Advisor

Director of Wealth Planning, Senior Wealth Advisor

B.M., DePauw University (Cum Laude)

21 years

2016

Michelle is a current member of the Estate Planning Council of Indianapolis and the Financial Planning Association.

Michelle is a current member of the Estate Planning Council of Indianapolis and the Financial Planning Association.

Director of G•PRO Sports, Senior Wealth Advisor

Director of G•PRO Sports, Senior Wealth Advisor

MBA, University of Cincinnati

B.S., University of Dayton

20 years

2019

Former Board member of Easterseals Crossroads, the Nora Alliance, and the Riley Cheer Guild. He was awarded the Indianapolis Business Journal’s “40 Under Forty” in 2017.

Chair of Saint Luke Catholic Church Finance Council, Riley Professional Advisors Council, Ex officio board member of Riley Cheer Guild

Former Board member of Easterseals Crossroads, the Nora Alliance, and the Riley Cheer Guild. He was awarded the Indianapolis Business Journal’s “40 Under Forty” in 2017.

Chair of Saint Luke Catholic Church Finance Council, Riley Professional Advisors Council, Ex officio board member of Riley Cheer Guild

Senior Wealth Advisor

Senior Wealth Advisor

B.A., Ball State University

25 years

2022

Dave is a current member of the Financial Planning Association.

Board Member of Indianapolis Baroque Orchestra

Dave is a current member of the Financial Planning Association.

Board Member of Indianapolis Baroque Orchestra

Wealth Advisor

Wealth Advisor

B.A., Theology – Valparaiso University

M.S., Personal Financial Planning – Kansas State University

9 years

2019

Kory is a current member of the Financial Planning Association of Greater Indiana.

Kory is a current member of the Financial Planning Association of Greater Indiana.

Associate Wealth Advisor

Associate Wealth Advisor

B.A., Criminology – Butler University

12 years

2023

Brebeuf Jesuit Girls Varsity Head Coach 2011-Present Founder Circle City Lacrosse Club 2015-Present

Brebeuf Jesuit Girls Varsity Head Coach 2011-Present Founder Circle City Lacrosse Club 2015-Present

Senior Manager, Client Services

Senior Manager, Client Services

Associate’s Degree, University of Indianapolis

30 years

1995

Who’s Who Behind the Scenes in Banking and Financial Services (2003).

Who’s Who Behind the Scenes in Banking and Financial Services (2003).

Senior Client Services Associate

Senior Client Services Associate

B.A., Indiana University-Purdue University Indianapolis

2022

Client Services Associate

Client Services Associate

B.S., Indiana University-Purdue University Indianapolis

4 years

2022

Private Investors

Goelzer helps different kinds of private clients fulfill their goals.

Client since 2010

Client since 1991

Client since 1999

Client since 2008

The executive had realized a significant decline in his net worth due to a decline in the value of his employer’s stock price. He was facing a lengthy delay in his target retirement date as well as the prospect of a modest lifestyle in retirement.

Sought investment growth and portfolio rebalancing to protect wealth from further downside risk

Wanted to find a new trusted advisor to help realize his financial goals.

The client hired Goelzer because he was familiar with its investment capabilities through his community service as the chairman of a not-for-profit’s investment committee.

Portfolio was reconstructed with the goal of improving the likelihood of having the wealth needed to reach the lifestyle he had envisioned.

Advised on how to handle stock options, including the timing and manner in which to exercise them.

Managed his concentrated stock position and established a periodic liquidation strategy that was compliant with company and SEC policies.

Family group unexpectedly faced with investment and estate planning issues upon the passing of the family patriarch (a firm client) when the family is surprised to learn of his significant wealth

Beneficiaries were unaware and unprepared to inherit their relative’s sizable wealth

Working with the family’s other professional advisors, Goelzer created a wealth transfer strategy to minimize the tax impact upon the death of the surviving spouse

Managed new portfolios designed to meet the specific needs of individual family members who had inherited large amounts of wealth

Faced with the prospect of a new lifestyle after divorce, our client had concerns about every aspect of her financial standing and needed trustworthy investment advice

Helped educate client and children on the importance of budgeting and saving

Devised a strategy to hedge capital gains and spread tax liability over time

Prepared a retirement and spending needs analysis and estimated future wealth projections

Set realistic spending expectations and redefined budget priorities

Constructed a well-diversified and tax efficient portfolio designed for growth as well as safety of principal

Financial education

Savings plan

Tax-efficient portfolio management

Disability insurance

Portfolio structuring for long-term

Portfolio tailored to client needs of long-term financial security

Client was also able to enjoy a lifestyle that provided for his income needs

Established tax-deferred savings “buckets” to help fund his retirement

Perspectives from Goelzer’s team of experts

To find the contact information for one of our team members, click here.

"*" indicates required fields